Discovering the Trick Duties of a Specialist Bookkeeper in Finance

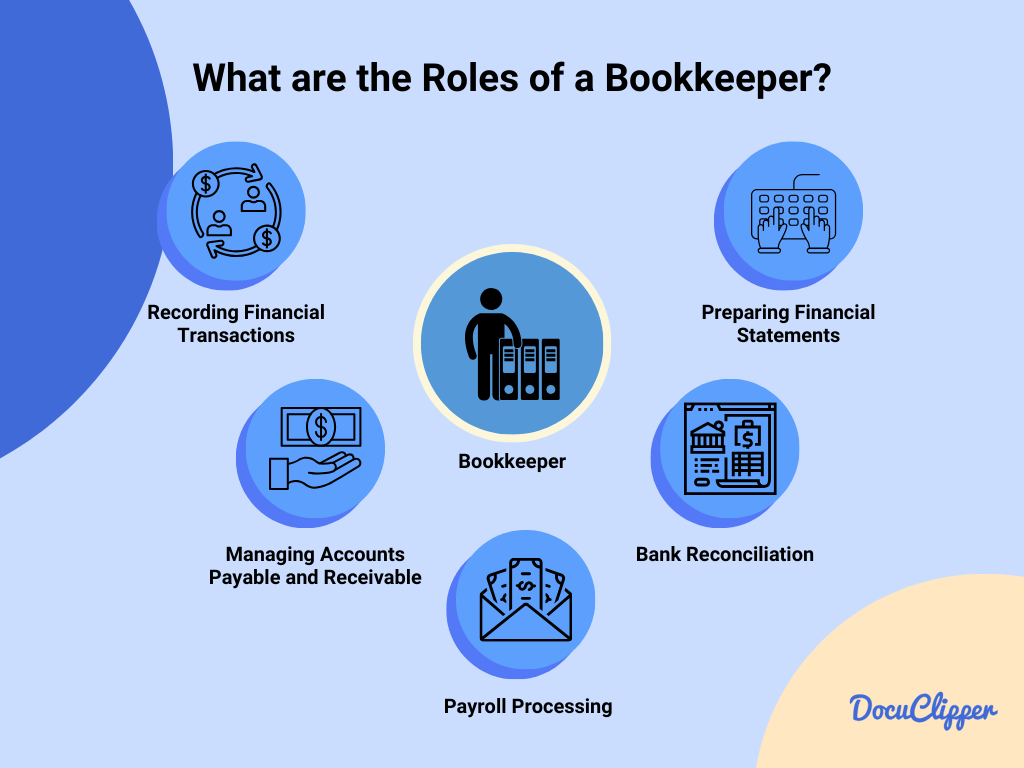

The function of a professional accountant is fundamental in the domain of money. They are charged with keeping exact monetary documents, managing accounts receivable and payable, and ensuring conformity with monetary guidelines. Furthermore, their obligation encompasses preparing financial declarations and records. Each of these duties contributes to the monetary health and wellness of an organization. However, the subtleties of their job commonly go unnoticed, elevating concerns regarding the effect of their experience on wider monetary techniques.

Preserving Accurate Financial Records

Keeping exact financial records is an important obligation for expert bookkeepers. This job calls for thorough focus to information and a complete understanding of monetary principles. Accountants are accountable for documenting all economic transactions, making certain that data is recorded consistently and properly. They use various audit software program and devices to improve the recording procedure, which enhances effectiveness and reduces the danger of mistakes.

Regular settlement of accounts is crucial, permitting bookkeepers to determine inconsistencies and correct them promptly. By keeping organized and current documents, they provide useful insights into the financial wellness of an organization. This duty likewise incorporates the prep work of economic statements, which act as a substantial resource for monitoring decision-making. Inevitably, the exact economic documents maintained by bookkeepers support compliance with regulatory needs and foster trust fund among stakeholders, therefore adding to the overall success of the service.

Taking Care Of Accounts Payable and Receivable

Effectively taking care of accounts payable and receivable is an essential aspect of a bookkeeper's function, assuring that a company's cash flow remains healthy and balanced. This obligation entails monitoring incoming and outward bound repayments, which enables for prompt payment and collections from customers while also assuring that the organization meets its economic obligations to vendors and vendors.

Bookkeepers have to preserve precise documents of billings, payment terms, and due dates, assisting in reliable communication with lenders and customers. By keeping an eye on these accounts, they can determine discrepancies or overdue accounts, enabling proactive procedures to solve problems before they intensify.

Additionally, an accountant's function includes resolving accounts to guarantee that all economic deals line up with bank statements and interior records. This diligence not only improves monetary transparency however additionally supports strategic monetary preparation, permitting the organization to allocate resources successfully and preserve a robust economic placement.

Ensuring Conformity With Financial Regulations

While steering with the facility landscape of financial policies, an accountant plays a necessary role in guaranteeing an organization abides by lawful requirements and standards. This obligation includes staying upgraded on modifications in tax obligation regulations, conformity requirements, and industry-specific regulations. Best Bookkeeping Calgary. By thoroughly tracking financial deals and maintaining precise records, the bookkeeper helps protect against offenses that can bring about fines or lawful problems

Additionally, the accountant checks internal controls to safeguard against scams and mismanagement. They execute procedures that advertise openness and liability within the economic framework of the company. Collaboration with auditors and regulatory bodies better solidifies compliance initiatives, as accountants provide needed documentation and support throughout evaluations.

Ultimately, the dedication to compliance not just secures the organization yet additionally boosts its credibility with stakeholders, cultivating count on and stability in its economic practices.

Preparing Financial Statements and Information

Preparing financial declarations and reports is an essential task for bookkeepers, as it supplies stakeholders with a clear overview of a company's financial health and wellness. Best Bookkeeping Calgary. These files, which normally include the equilibrium sheet, earnings statement, and capital statement, sum up the monetary activities and setting of business over a particular duration. Bookkeepers meticulously collect, document, and organize monetary information to assure precision and conformity with relevant accounting standards

The preparation procedure includes integrating accounts, confirming purchases, and adjusting entries as required. With this comprehensive technique, bookkeepers assist guarantee that monetary statements mirror truth state of the company's finances. Additionally, prompt prep work of these reports is important for efficient decision-making by monitoring, capitalists, and governing bodies. By supplying clear and precise financial paperwork, accountants play a vital duty in keeping openness and depend on within the monetary ecosystem of the company.

Giving Financial Insights and Evaluation

Accountants assess financial information to give valuable insights that inform critical decision-making within a company. By carefully examining patterns in income, expenditures, and money flow, they help recognize locations for improvement and emphasize possible threats. Bookkeeper Calgary. These understandings allow management to allocate sources much more properly and readjust company strategies as necessary

Furthermore, by leveraging economic software program and logical tools, bookkeepers can provide data in a clear and understandable format, making it much easier for decision-makers to grasp complicated financial issues. Inevitably, the understandings originated from a bookkeeper's analysis empower organizations to make enlightened selections that boost earnings and drive growth.

Frequently Asked Inquiries

What Software Program Devices Do Expert Bookkeepers Typically Utilize?

Professional accountants normally use software program tools such as copyright, Xero, Sage, and FreshBooks. These applications improve financial monitoring, assist in exact record-keeping, and enhance reporting abilities, enabling reliable handling of financial transactions and information analysis.

How Does an Accountant Differ From an Accountant?

An accountant mostly handles daily monetary purchases and record-keeping, while an accounting professional evaluates monetary data, prepares statements, and offers tactical advice. Their roles complement each various other however concentrate on distinctive elements of economic management.

What Qualifications Are Required to End Up Being an Accountant?

To come to be an accountant, people typically require a secondary school diploma, proficiency in accountancy software application, and understanding of fundamental accountancy principles. Some may go after qualifications or associate levels to improve their certifications and work potential customers.

Exactly How Commonly Should Financial Records Be Updated?

Financial documents must be upgraded on a regular basis, ideally on a daily or regular basis, to ensure accuracy and timeliness. This practice enables efficient tracking of economic tasks and sustains educated decision-making within the organization.

Can a Bookkeeper Help With Tax Obligation Prep Work?

Yes, an accountant can assist with tax prep work by organizing monetary documents, guaranteeing precise documentation, and supplying essential reports. Their proficiency helps enhance the procedure, making it simpler for tax specialists to full returns effectively.

They are tasked with preserving more info accurate financial records, managing accounts receivable and payable, and guaranteeing compliance with financial regulations. Preparing financial statements and records is a vital job for bookkeepers, as it gives stakeholders with a clear summary of a company's economic health and wellness. With this detailed method, accountants aid guarantee that financial declarations reflect the true state of the company's finances. By leveraging economic software and logical devices, bookkeepers can offer information in a understandable and clear layout, making it less complicated for decision-makers to grasp complicated monetary problems. A bookkeeper largely manages daily economic purchases and record-keeping, while an accounting professional assesses economic information, prepares declarations, and provides critical guidance.